The Ultimate List of 99 Fintech Companies for 2025

As you navigate the rapidly evolving landscape of financial technology, it’s clear that fintech companies are revolutionizing the way you manage your finances, invest, and conduct transactions. The fintech industry has grown exponentially over the past decade, driven by innovations in blockchain, artificial intelligence (AI), and mobile payments.

we’ll delve into the trends shaping the future of fintech, highlight top companies leading the charge, and explore emerging startups that are poised to disrupt traditional financial systems.

Fintech Trends Driving Innovation in 2025

The fintech sector is witnessing a surge in innovative technologies that are transforming financial services. Here are some of the key trends you should be aware of:

- Embedded Finance: This trend involves integrating financial services into non-financial platforms. For instance, e-commerce sites can now offer financing options directly to customers, making it easier for you to purchase products without needing to leave the platform. Companies like Stripe and Square are pioneers in this space, providing seamless payment experiences.

- Decentralized Finance (DeFi): DeFi platforms are gaining traction by offering decentralized lending, borrowing, and insurance services. This shift towards decentralized systems is empowering users with greater control over their financial transactions. Platforms like Aave and Compound are leading the DeFi revolution.

- AI and Hyper-Personalization: AI-driven solutions are enabling fintech companies to offer hyper-personalized financial services. By analyzing user behavior and financial data, AI can help tailor financial products to meet individual needs more effectively. This not only enhances user experience but also improves financial management.

- Quantum Computing: While still in its early stages, quantum computing has the potential to revolutionize financial modeling and risk analysis. It can process complex data sets much faster than traditional computers, allowing for more accurate predictions and better decision-making.\

Top Fintech Companies Revolutionizing Payments

Payment systems are at the heart of fintech innovation. Here are some of the top companies changing the way you make transactions:

- Mobile Payment Platforms: Companies like Venmo, Apple Pay, and Stripe are leading the way in mobile payments. These platforms have made it easier for you to send money, pay bills, and make purchases using your smartphone.

- Cryptocurrency Payment Solutions: Blockchain-based firms are enabling secure and fast transactions. For example, Ripple is known for its cross-border payment solutions that reduce transaction times and costs.

- Cross-Border Payment Innovators: Firms like TransferWise (now Wise) are simplifying international payments by reducing fees and speeding up processing times. This has been a game-changer for individuals and businesses alike.

What are the top fintech companies by revenue in 2025

Determining the top fintech companies by revenue for 2025 is challenging without specific financial data for each company. However, we can look at some of the prominent fintech companies and their categories to understand which ones are likely to be among the top revenue generators based on their market presence and growth trends.

Top Fintech Companies by Category

- Payments and Digital Banking:

- PayPal: Known for its payment processing services, PayPal is a leader in the fintech space.

- Stripe: Offers a suite of online payment processing tools for businesses.

- Revolut: A financial superapp providing low-fee global spending and currency exchange.

- Cryptocurrency and Blockchain:

- Binance: One of the largest cryptocurrency exchanges globally.

- Coinbase: A leading platform for buying, selling, and managing cryptocurrencies.

- Buy Now, Pay Later (BNPL) and Lending:

- Klarna: Offers flexible payment options for consumers.

- Affirm: Provides consumer financing solutions.

- Investments and Trading:

- TradingView: A platform for tracking and analyzing financial markets.

- Groww: Offers stock and mutual fund investments in India.

- Digital Wallets and Mobile Payments:

- Alipay: A leading digital payment platform in China.

- PhonePe: A popular UPI-based payment app in India.

Revenue Estimates

While exact revenue figures for 2025 are not available, companies like PayPal, Stripe, and Binance are likely to be among the top revenue generators due to their large user bases and market dominance. Klarna and Affirm are also significant players in the BNPL space, with substantial revenue potential.

To accurately rank fintech companies by revenue for 2025, one would need access to their financial reports or projections. However, based on market presence and growth trends, companies like PayPal, Stripe, Binance, Klarna, and Affirm are likely to be among the top performers.

Leading Fintech Companies in Lending and Credit

The lending and credit sector has seen significant disruption thanks to fintech innovations. Here are some of the leading companies in this space:

- Peer-to-Peer Lending Platforms: Companies like LendingClub and Prosper have created platforms where individuals can lend and borrow money directly, bypassing traditional banks. This model offers more flexible terms and often better interest rates.

- BNPL (Buy Now, Pay Later) Providers: Firms like Klarna and Affirm are transforming consumer financing by allowing you to purchase products now and pay later in installments. This has become particularly popular among younger consumers.

- AI-Powered Credit Assessment Tools: Fintechs are using machine learning to improve credit scoring and loan approvals. This approach can provide more accurate assessments of creditworthiness, making it easier for individuals and businesses to access credit.

Fintech Companies Pioneering Blockchain and DeFi

Blockchain and DeFi are at the forefront of fintech innovation, offering decentralized solutions that are changing the financial landscape:

- Blockchain Innovators: Companies like Ripple and Chain are revolutionizing transaction security and transparency. Blockchain technology ensures that transactions are secure, immutable, and transparent.

- DeFi Leaders: Platforms like Aave and Compound are leading the DeFi revolution by offering decentralized lending and borrowing solutions. These platforms allow users to earn interest on their cryptocurrencies and borrow against them without needing traditional intermediaries.

- Crypto Asset Management Firms: Companies providing tools for trading, investing, and managing cryptocurrencies are essential for the growth of the crypto market. Firms like Coinbase and Binance offer a range of services from trading to custody solutions.

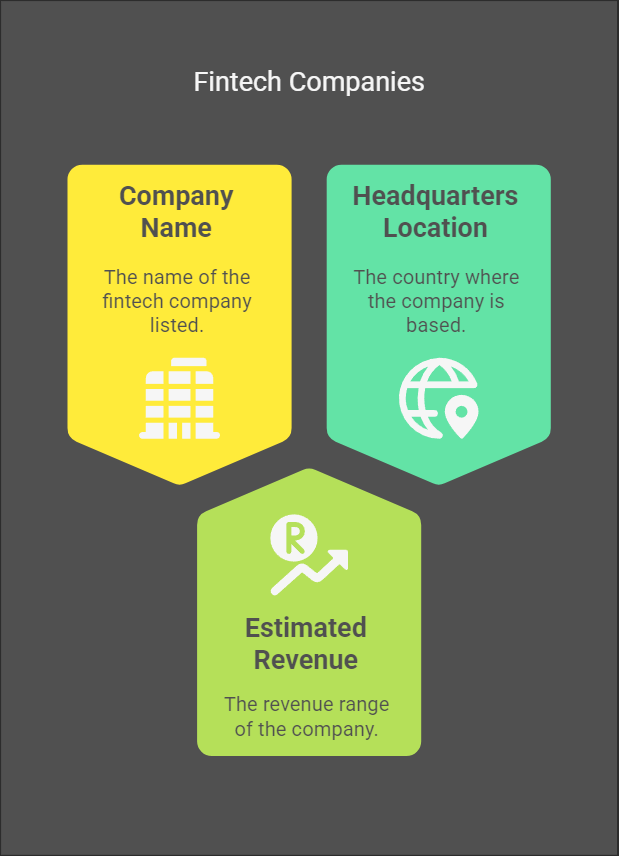

Top 99 fintech companies for 2025

Here’s a detailed table listing 99 top fintech companies for 2025, compiled from the available sources:

| Company Name | Estimated Revenue Range | Headquarters Location |

|---|---|---|

| BlackRock | $10B+ | United States |

| PayPal | $10B+ | United States |

| Bank of America | $10B+ | United States |

| QNB Group | $10B+ | Qatar |

| IndusInd Bank | $10B+ | India |

| Wells Fargo | $10B+ | United States |

| Majid Al Futtaim Holdings LLC. | $10B+ | United Arab Emirates |

| ANZ | $10B+ | Australia |

| Intuit | $10B+ | United States |

| Stripe | $10B+ | United States |

| Fiserv | $10B+ | United States |

| Rakuten | $10B+ | Japan |

| Banco Bilbao Vizcaya Argentaria (BBVA) | $10B+ | Spain |

| National Australia Bank (NAB) | $10B+ | Australia |

| Credefi | $10B+ | Bulgaria |

| Cathay Financial Holding | $10B+ | Taiwan |

| Cielo SA | $10B+ | Brazil |

| PagSeguro | $10B+ | Brazil |

| Lufax | $10B+ | China |

| China CITIC Bank | $10B+ | China |

| SoftBank Capital | $10B+ | Japan |

| Sinopac Financial Holdings | $10B+ | Taiwan |

| PayPal Incubator | $10B+ | Singapore |

| Datalend | $10B+ | United States |

| Alliance Wealth Partners | $10B+ | United States |

| Affirm | $1B to $10B | United States |

| National Stock Exchange | $1B to $10B | India |

| Klarna | $1B to $10B | Sweden |

| Robinhood | $1B to $10B | United States |

| Modulr | $1B to $10B | United Kingdom |

| Nuvei | $1B to $10B | Canada |

| Coinbase | $1B to $10B | United States |

| Hashdex | $1B to $10B | Brazil |

| Circle | $1B to $10B | United States |

| Binance | $1B to $10B | Malta |

| Aye Finance | $1B to $10B | India |

| Cashfree Payments | $1B to $10B | India |

| Best Egg | $1B to $10B | United States |

| AtoB | $1B to $10B | United States |

| Amount | $1B to $10B | United States |

| Sokin | $1B to $10B | United Kingdom |

| BVNK | $1B to $10B | United Kingdom |

| Forward Financing | $1B to $10B | United States |

| Kiavi | $1B to $10B | United States |

| FPL Technologies | $1B to $10B |

Emerging Fintech Startups to Watch in 2025

As the fintech landscape continues to evolve, new startups are emerging with innovative solutions:

- RegTech Firms: Startups focusing on regulatory compliance tools are helping financial institutions navigate complex regulatory environments more efficiently. Companies like Ayasdi are using AI to automate compliance processes.

- Super-App Developers: New entrants are aiming to create all-in-one financial platforms that combine payments, lending, investments, and more. These super-apps aim to simplify your financial life by offering a comprehensive suite of services in one place.

- Accessibility-Focused Startups: Companies innovating to serve unbanked and underbanked populations globally are crucial for financial inclusion. Startups like M-Pesa have shown how mobile payments can bring financial services to millions of people in developing countries.

Conclusion

The fintech industry is on the cusp of a revolution, driven by technological advancements and innovative business models. As you explore the world of fintech, remember that these companies are not just changing how you manage your finances but also creating new opportunities for investment, lending, and financial inclusion.

Take Action Today!

Explore the Full List: Dive into our comprehensive list of 99 fintech companies to discover groundbreaking innovations that are shaping the future of finance.

- Stay Updated: Follow industry leaders and fintech news to stay ahead of the curve.

- Engage with Fintech Communities: Join forums and discussions to learn from experts and share your insights.

By embracing these trends and innovations, you can unlock new financial opportunities and be part of the fintech revolution that’s transforming the world. Whether you’re an investor, entrepreneur, or simply someone interested in the future of finance, this is an exciting time to be involved in fintech.