The world of cryptocurrency never sleeps — and neither does Bitcoin. Whether you’re an investor, trader, or just curious, tracking the Bitcoin price live is essential. In this post, we provide real-time updates, analysis, and insights to help you stay ahead in 2025.

Bitcoin Price Live Questions Answered

Q1: How often does the Bitcoin price change?

A: Every second. Literally. Bitcoin trades 24/7 on global exchanges, so the price updates continuously. Tools like TradingView or CoinMarketCap reflect these live movements in near real-time.

If you’re using a mobile app or platform that feels “stale,” make sure you refresh often or use one that auto-updates every second or two.

Where can I track Bitcoin price live?

A: Because each exchange has its own order book, volume, and trading activity. Bitcoin isn’t like a stock traded on one central exchange — it’s decentralized. So, price differences of a few dollars (or more) are totally normal between platforms like Binance, Coinbase, and Kraken.

To get the most balanced view, check an aggregator like CoinGecko or CryptoCompare.

Why does Bitcoin price change so fast?

A: Bitcoin trades globally, 24/7. Factors like investor behavior, news events, and liquidity cause rapid price shifts.

Is the Bitcoin price the same on all exchanges?

A: Not always. Prices may differ slightly due to exchange liquidity, fees, and volume.

Can I predict Bitcoin’s future price?

A: While no prediction is certain, technical analysis and AI tools can provide probability-based forecasts.

Bitcoin Price Live : Why You Need to Stay Ahead in Real Time

If you’ve ever watched the crypto markets, you already know one thing for sure — Bitcoin never sleeps. While traditional assets take weekends off, Bitcoin keeps moving 24/7, and the changes can be lightning-fast. That’s why having access to the Bitcoin price live isn’t just helpful — it’s essential.

Whether you’re a full-time crypto investor, a business owner dabbling in digital assets, or a student exploring blockchain for the first time, understanding Bitcoin’s price in real time gives you an edge. You’re not just reacting to market shifts; you’re staying ahead of them. That kind of awareness can mean the difference between a strategic trade and a missed opportunity.

But let’s be honest: watching Bitcoin’s price tick up or down isn’t enough. You need to understand what’s moving it — what’s behind the data. Where are the trends pointing? What should you watch for next? And perhaps more importantly, how can you separate noise from real insight?

Let’s dive in. The Bitcoin price isn’t waiting — and neither should you.

Understanding Live Bitcoin Price Data

How to Read and Use Bitcoin Price Live Data Without Getting Lost

Let’s face it — staring at a live chart with green and red candles flying up and down can feel like you’re watching a financial heart monitor. But behind the rapid movement, there’s logic, rhythm, and data — if you know how to read it.

What Does “Bitcoin Price Live” Actually Mean?

When you see the term Bitcoin price live, it refers to the real-time value of Bitcoin being traded on global exchanges like Binance, Coinbase, Kraken, and others. But here’s something important you should know: there is no single global price for Bitcoin.

That’s right — the price you see depends on the exchange you’re looking at. Each exchange has its own supply and demand, fees, and liquidity. The price on Binance might differ slightly from Coinbase, especially during periods of high volatility.

That’s why smart traders use aggregators like CoinMarketCap or TradingView. These platforms collect data from multiple exchanges and display a weighted average that reflects the market more accurately. So when you want to monitor the Bitcoin price live, make sure you’re using a trusted source — not just a tweet or a Reddit post.

Key Terms You Should Know

To make the most of live pricing data, keep these essential terms in mind:

- Spot Price: The current market price of Bitcoin at this moment.

- Bid/Ask Price: What buyers are willing to pay (bid) vs. what sellers want (ask).

- Volume: How much Bitcoin is being traded — high volume often means high activity or volatility.

- Market Cap: The total value of all Bitcoin in circulation (price × supply).

- 24H Change: How much the price has moved in the last 24 hours — crucial for tracking short-term trends.

Best Tools to Track Bitcoin Price Live

Here are a few tools you can trust for accurate, real-time data:

- TradingView – Advanced charting and analysis

- CoinMarketCap – Global price aggregation

- CoinGecko – Independent live data with community insights

- CryptoCompare – Useful for historical comparisons

- Binance App – Live prices straight from one of the biggest exchanges

Each of these tools gives you the ability to set alerts, analyze trends, and even access mobile widgets to track Bitcoin on the go.

Real-Time = Real Decisions

By watching the Bitcoin price live, you gain more than just numbers — you gain timing. You’ll see when momentum builds, when corrections begin, and when major market shifts are underway.

But remember: data is only as valuable as the decisions you make with it. Knowing when to act — and when to wait — comes from combining live data with knowledge, strategy, and patience.

7 thing make the Price of Bitcoin moves ?

What Makes Bitcoin Go Up or Down? The Real Drivers Behind the Live Price

Watching the Bitcoin price live can be thrilling, but if you don’t know why it’s moving, you’re flying blind. The truth is, Bitcoin’s value is influenced by a complex mix of market psychology, macroeconomics, and technology. Let’s unpack the real forces behind the price — so you’re not just watching numbers but understanding them.

1. Supply and Demand

Just like any other market, Bitcoin’s price is heavily dictated by how many people want to buy (demand) vs. how many are willing to sell (supply). But unlike fiat currencies, Bitcoin has a fixed supply of 21 million coins. That scarcity alone makes it behave differently.

You might notice price spikes when there’s sudden buying pressure — like during a bull run or after big adoption news. On the flip side, fear-driven selloffs flood the market with supply, pushing prices down quickly.

2. News & Media Hype

You’ve probably seen it before — Bitcoin surges after Elon Musk tweets, or it drops after negative headlines from governments. That’s because crypto markets are still driven in part by sentiment. Positive news can trigger mass buying. Fear, uncertainty, and doubt (aka FUD) can crash the price in hours.

What this means for you: Pay attention to the tone of the media, not just the facts. Headlines can drive emotional trading more than logic.

3. Global Regulation & Legal Frameworks

Governments can move markets with a single statement. For instance:

- China banning crypto mining caused price drops in 2021.

- The U.S. approving Bitcoin ETFs helped trigger bullish sentiment in 2024.

As crypto matures, regulations will become even more impactful. For you, this means staying informed on global regulatory trends is no longer optional — it’s vital to understanding Bitcoin’s price direction.

4. Institutional Investment

When companies or large hedge funds move into crypto, the market listens. MicroStrategy, BlackRock, and Tesla have all made headlines by buying Bitcoin. This kind of institutional involvement creates credibility and momentum, which in turn encourages retail investors like you to join the rally.

The more Wall Street pays attention to Bitcoin, the more volatile — and influential — these moves can become.

5. Technology Upgrades & Protocol Changes

Bitcoin isn’t static. Network upgrades like Taproot or developments in the Lightning Network can signal to the market that the tech is evolving. These changes often influence long-term investor confidence, especially for business owners using Bitcoin as a payment method.

When tech improves scalability or privacy, traders view it as a positive sign for future adoption — which can lead to upward price pressure.

6. Market Psychology & Trader Behavior

Believe it or not, a lot of price action is based on how traders think. Patterns like FOMO (fear of missing out), panic selling, and herd mentality can push the price wildly — even without major news.

You can spot this by watching for:

- Sudden price spikes with no clear reason (possibly a pump)

- Massive dumps after a long upward trend (profit-taking)

- Overreactions to minor news events

Smart traders stay calm, while reactive ones create volatility. Know the difference — and stay cool.

7. Technical Analysis & Bots

Many traders rely on technical indicators like RSI, moving averages, and Fibonacci levels. When enough traders act on the same signals, it can create the very movement they’re expecting.

Add to that high-frequency trading bots running algorithms 24/7, and you get a fast-moving market that reacts to both numbers and human emotions in real time.

Bottom Line: You don’t need to guess what’s moving the market — you need to observe, learn, and connect the dots. When you understand the drivers, the bitcoin price live feed becomes more than just data — it becomes a tool.

Challenges & Limitations of Tracking Bitcoin Price Live

Why Watching the Bitcoin Price Live Can Sometimes Work Against You

Tracking the Bitcoin price live gives you power — but with great power comes a few pitfalls. Real-time data is fast, raw, and emotional. If you’re not careful, it can lead to stress-driven decisions, poor judgment, and even burnout. Let’s break down the key limitations you should know about so you can use live data smartly, not blindly.

1. Information Overload

Live price feeds, breaking news alerts, and Twitter updates every few seconds — it’s a lot. And your brain can only process so much at once. If you’re constantly watching the price move tick by tick, you risk decision fatigue.

You might start to overanalyze small movements or misinterpret normal volatility as a major signal. The result? Bad trades based on noise, not data.

Your move: Step back. Set alerts. Focus on patterns, not individual price blips.

2. Short-Term Thinking

When you watch Bitcoin’s price live all day, it’s easy to slip into a trader mindset — even if you’re supposed to be a long-term investor. Minute-by-minute price changes can tempt you to enter or exit positions too early.

But remember: Bitcoin has always been volatile in the short term and rewarding in the long run.

Your move: Match your time horizon with your goals. If you’re in it for years, stop reacting to every $500 dip or pump.

3. Inconsistent Prices Across Exchanges

Here’s a little-known fact: Bitcoin doesn’t have one single price. Every exchange sets its own value based on trading activity. That means:

- The price on Binance may be slightly different from Coinbase.

- International platforms may show varying prices due to currency differences.

If you’re basing your trade or investment decision on just one exchange’s data, you might not be seeing the full picture.

Your move: Use aggregator tools like CoinMarketCap or CoinGecko to get a better market-wide average.

4. Emotional Decision-Making

Live price feeds are a double-edged sword — they give you data, but they can also trigger your emotions. Fear, excitement, anxiety, or greed… these reactions can take over quickly when you’re glued to a fluctuating screen.

This is especially dangerous when combined with leverage or risky positions.

Your move: Use a checklist or trading journal to stick to rational strategies — not emotional impulses.

5. Poor Internet or Platform Lag

Sometimes it’s not you — it’s the tech. Laggy platforms, data refresh delays, or server outages can all cause you to act on outdated information. In fast-moving markets like crypto, even a 5-second delay can impact your trade or insight.

Your move: Make sure you’re using reliable platforms with real-time updates — and always cross-check before making a move.

6. Data Without Context

Just knowing the price isn’t enough. A sudden jump from $60,000 to $61,000 might seem exciting, but is it backed by volume? News? Whale activity? Or is it just a short squeeze?

Live data lacks context unless you pair it with news feeds, order book analysis, or technical signals.

Your move: Supplement price feeds with tools that show you what’s happening around the price — not just the price itself.

So Should You Watch the Bitcoin Price Live?

Absolutely — but not obsessively. Use it as a tool, not a distraction. Combine live data with smart strategy, long-term vision, and context, and it becomes one of your most powerful assets.

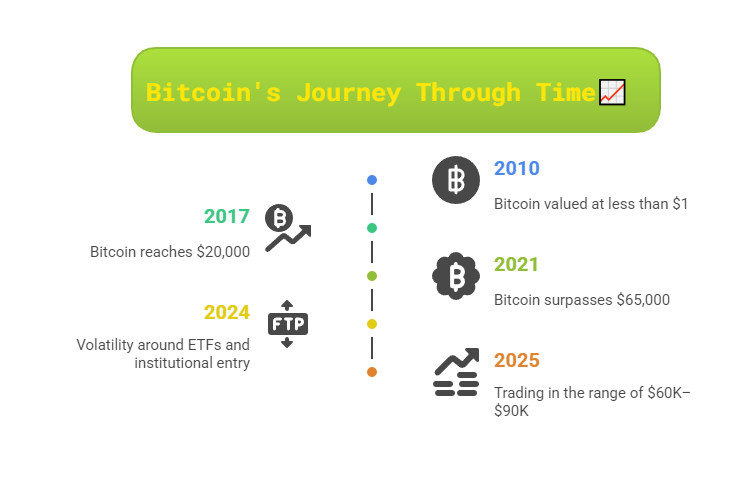

Trends Shaping Bitcoin Price in 2025 and Beyond

What’s Next for Bitcoin? Key Trends That Will Impact the Live Price Moving Forward

Watching the Bitcoin price live gives you the current pulse. But to stay truly ahead, you need to look at what’s coming. If you’re serious about staying on top of crypto, you have to keep one eye on the real-time price — and the other on the road ahead.

Here are the top trends shaping Bitcoin’s price in 2025 and the years beyond. These will define how the market behaves, how institutions respond, and how you make decisions.

1. Institutional Adoption Is Going Mainstream

For years, crypto was the Wild West. Now? It’s moving toward Wall Street.

In 2024, we saw BlackRock and Fidelity get approval for Bitcoin ETFs. That opened the floodgates for pension funds, asset managers, and banks to finally step into Bitcoin legally and confidently.

You’re likely to see:

- More countries approving spot Bitcoin ETFs

- Pension funds allocating 1–5% to BTC

- Custody services improving for institutions

What this means for you: More money flowing in = more liquidity and likely more long-term upward pressure. But expect sharper moves as large players enter and exit positions.

2. Technology Upgrades & Layer-2 Expansion

Bitcoin isn’t just sitting still. Upgrades like Taproot are improving privacy and smart contract capabilities. Meanwhile, Layer 2 solutions (like the Lightning Network) are scaling transactions at near-zero fees.

What this means:

- Bitcoin can now be used more easily for microtransactions and payments

- Business adoption is more feasible

- Retailers and platforms can integrate BTC as payment faster

Impact on price: Greater utility = stronger fundamentals = higher investor confidence.

3. Halving Effects Still Playing Out

The last Bitcoin halving occurred in April 2024. If you’re unfamiliar, this is when the block reward miners receive is cut in half, reducing the rate at which new BTC enters circulation.

Historically, each halving leads to:

- Supply shock (less BTC mined daily)

- Price appreciation over the following 12–18 months

In 2025, we’re in the heart of this post-halving window. You might already be seeing the supply squeeze push prices up.

4. Tighter Regulation (But with Clarity)

Governments are getting more involved — but in many regions, that’s now a good thing. Instead of vague bans or threats, 2025 is shaping up to be a year of regulatory clarity.

Expect:

- Clearer crypto tax frameworks

- Stricter KYC/AML enforcement on exchanges

- Legal pathways for institutional crypto use

Why it matters: Regulation brings legitimacy. And legitimacy brings stability, investment, and broader adoption.

5. AI and Automation in Trading

More investors (including you) now have access to AI-powered trading tools that analyze real-time Bitcoin price data, detect patterns, and automate trades.

These tools are:

- Reducing emotion-driven errors

- Making short-term trading more efficient

- Leveling the playing field for retail investors

As automation grows, expect Bitcoin’s price to react faster — but potentially with more stability over time due to fewer panic-driven decisions.

6. Wider Integration Into Consumer Apps

You’ll see Bitcoin appearing in:

- Wallets like PayPal, Cash App, and Venmo

- Rewards programs (BTC cashback)

- Gaming platforms, online stores, and even social networks

All of this fuels adoption — even among people who don’t call themselves “investors.”

The Big Picture: Watching the Bitcoin price live helps you react to the moment. But watching the trends lets you prepare for what’s next. Smart investors blend both.

Bitcoin Doesn’t Wait — And Neither Should You

You’ve just taken a deep dive into everything that matters about tracking the Bitcoin price live. From real-time data tools to market psychology, from institutional trends to common pitfalls — you now have what most casual observers don’t: clarity.

And in a market that never sleeps, clarity is your biggest advantage.

Whether you’re a student learning the ropes, a business owner eyeing BTC for payments, or an investor planning your next move, live price data isn’t just a number. It’s a signal. A pulse. A conversation between markets, media, and momentum. If you know how to listen, you know how to act.

But remember — tracking the Bitcoin price live is only one piece of the puzzle.

- You still need strategy.

- You still need patience.

- And you still need to filter the signal from the noise.

The most successful Bitcoin users — whether they trade daily or hold for decades — combine live information with long-term vision. They use tools to track the moment but always act with intention.

🚀 Now It’s Your Move

If you’ve made it this far, here’s your action plan:

✅ Choose your tracking tool

Set up real-time alerts using apps like TradingView, Binance, or CoinMarketCap.

✅ Define your strategy

Are you trading short-term moves? Investing for the next 5 years? Build a plan that matches your goals — not your emotions.

✅ Follow macro and tech trends

Keep an eye on regulation, institutional interest, and Bitcoin upgrades. These shape tomorrow’s price far more than today’s noise.

✅ Bookmark this guide

Prices change, trends evolve — but your foundation matters most. Return here whenever you need clarity.

Stay Ahead. Stay Informed. Stay in Control.

Because Bitcoin isn’t just the future of money — it’s a live, breathing financial ecosystem. And now, you know how to track it, read it, and own your part in it.

If this guide helped you make better sense of the crypto space, share it with someone who’s still lost in the price swings.

👉 Got questions? Leave a comment.

👉 Want deeper insights? Subscribe to our newsletter.

👉 Ready to level up? Explore our crypto trading tools and strategy guides.

You’re not just watching Bitcoin anymore. You’re understanding it.