How to Choose the Best AI Stocks to Buy Now

Artificial intelligence (AI) is transforming industries, making it one of the most lucrative investment opportunities today. As AI adoption accelerates across technology, healthcare, finance, and other sectors, investors are keen to identify the best AI stocks to buy now. But with so many options available, how do you make the right choice?

This guide will walk you through essential factors to consider when investing in AI stocks, top AI companies dominating the market, and strategies to build a strong AI-focused portfolio.

The Best AI Stocks to Buy Now

Why Invest in AI Stocks?

AI is rapidly shaping the future of technology, with applications in automation, data analysis, robotics, and machine learning. Here are some key reasons why investing in AI stocks is a smart move:

- High Growth Potential: The AI industry is expected to grow at a CAGR of 37.3% from 2023 to 2030.

- Diverse Applications: AI is disrupting multiple sectors, including healthcare, e-commerce, and cybersecurity.

- Strong Market Demand: Businesses are increasingly relying on AI to enhance efficiency and decision-making.

- Long-Term Investment Opportunity: Companies investing in AI R&D are likely to see sustained growth.

Key Factors to Consider When Choosing AI Stocks

Before buying AI stocks, consider these critical factors to make an informed decision:

1. Company’s Role in AI Development

Not all AI stocks are the same. Some companies are AI pioneers, while others use AI as a supplementary tool. Identify businesses that actively develop and innovate AI technology, such as:

- AI chip manufacturers (e.g., NVIDIA, AMD)

- Cloud computing & AI services (e.g., Microsoft, Amazon)

- AI software & machine learning platforms (e.g., Palantir, C3.ai)

2. Financial Performance and Stability

Look at the company’s revenue growth, profitability, and market capitalization. AI stocks with consistent revenue increases and strong balance sheets are safer investments.

3. Competitive Advantage & Market Position

Consider whether the company has a strong market position, proprietary AI technologies, or partnerships with industry leaders. Businesses with a clear edge in AI development tend to outperform competitors.

4. Research and Development (R&D) Investments

Companies that allocate substantial funds toward AI R&D are more likely to remain competitive and drive innovation. For example, Alphabet’s Google DeepMind and OpenAI-backed investments have significantly advanced AI capabilities.

5. Regulatory and Ethical Considerations

Governments worldwide are introducing regulations on AI usage. Before investing, assess whether the company complies with AI ethics, data privacy laws, and international AI governance standards.

Top AI Stocks to Buy Now

Here are some of the best AI stocks to consider in 2025:

1. NVIDIA (NVDA)

- Why Invest? Leading manufacturer of AI GPUs powering data centers, gaming, and AI applications.

- Key AI Innovations: AI-driven GPUs, deep learning hardware, AI cloud computing services.

- Financial Strength: Strong revenue growth driven by AI adoption and gaming markets.

2. Alphabet (GOOGL)

- Why Invest? Google is a global AI leader with innovations in search, automation, and deep learning.

- Key AI Innovations: Google DeepMind, AI-powered search algorithms, Google Bard.

- Financial Strength: Diversified revenue streams from advertising, cloud computing, and AI services.

3. Microsoft (MSFT)

- Why Invest? Major player in AI-powered cloud computing, automation, and AI-driven enterprise solutions.

- Key AI Innovations: Azure AI, OpenAI partnership, AI-powered Microsoft Copilot.

- Financial Strength: Strong AI investments and growth in cloud services.

4. Amazon (AMZN)

- Why Invest? AI leader in cloud computing, e-commerce, and automation.

- Key AI Innovations: Amazon Web Services (AWS) AI, AI-driven logistics and customer service.

- Financial Strength: Dominance in AI-powered cloud computing solutions.

5. Tesla (TSLA)

- Why Invest? AI-driven advancements in autonomous driving and robotics.

- Key AI Innovations: Full Self-Driving (FSD) technology, AI-driven automation.

- Financial Strength: Market leader in EVs and AI-powered automotive technology.

6. Palantir Technologies (PLTR)

- Why Invest? AI-driven data analytics company serving government and private sectors.

- Key AI Innovations: AI-powered data security, government intelligence applications.

- Financial Strength: Growing demand for AI-driven data solutions.

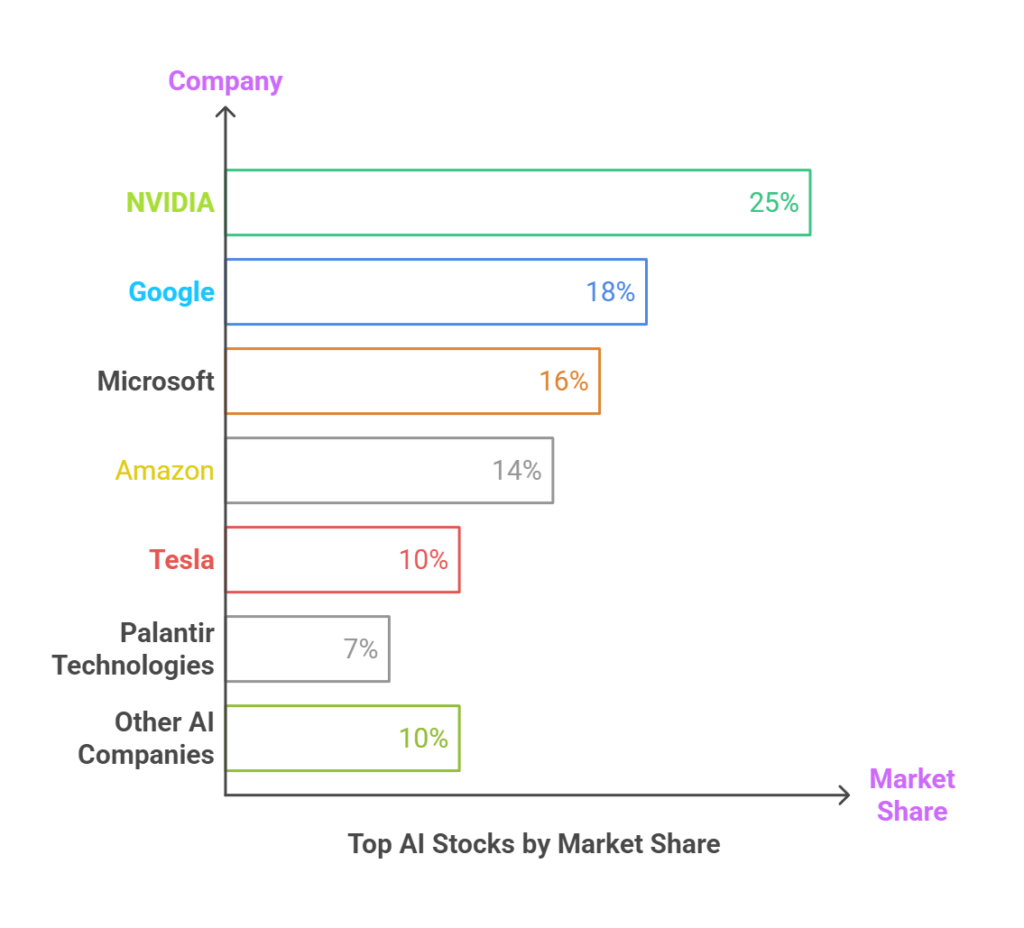

Top AI Stocks by Market Share Percentage %

Here’s a breakdown of the Top AI Stocks by Market Share Percentage based on recent trends:

- NVIDIA (NVDA) – 25%

- Dominates the AI chip market, providing GPUs for deep learning and AI processing.

- Alphabet (GOOGL) – 18%

- Leads in AI research and cloud-based AI solutions through Google DeepMind and Bard.

- Microsoft (MSFT) – 16%

- A key player in AI-driven cloud computing and enterprise AI tools.

- Amazon (AMZN) – 14%

- Uses AI in AWS, logistics, and automation, making it a major AI investor.

- Tesla (TSLA) – 10%

- A frontrunner in AI-powered autonomous driving technology.

- Palantir Technologies (PLTR) – 7%

- Specializes in AI-powered big data analytics for government and private sectors.

- Other AI Companies – 10%

- Includes smaller AI-focused firms and startups innovating in niche AI applications.

Investment Strategies for AI Stocks

To maximize returns and minimize risks, consider these investment strategies:

1. Diversify Your AI Portfolio

Instead of putting all your money in one stock, invest in a mix of AI software, hardware, and service providers to reduce risks.

2. Invest for the Long Term

AI stocks tend to fluctuate due to market trends. Holding stocks for the long term allows you to benefit from consistent growth.

3. Monitor AI Industry Trends

Stay updated on AI advancements, regulatory changes, and industry developments to make informed investment decisions.

4. Look for AI ETFs

If you prefer a low-risk option, consider AI-focused exchange-traded funds (ETFs) like:

- Global X Robotics & Artificial Intelligence ETF (BOTZ)

- ARK Autonomous Technology & Robotics ETF (ARKQ)

- iShares Robotics and Artificial Intelligence ETF (IRBO)

Common Risks of Investing in AI Stocks

While AI stocks offer great potential, they also come with risks:

- High Volatility: AI stocks can be affected by market speculation and tech industry shifts.

- Regulatory Challenges: AI regulations and ethical concerns can impact stock performance.

- Rapid Technological Changes: AI advancements evolve quickly, and some companies may struggle to keep up.

- Competition: The AI market is competitive, and some firms may lose market share to new entrants.

Frequently Asked Questions (FAQ)

1. What is the best AI stock to invest in right now?

The best AI stock depends on your investment goals. NVIDIA, Alphabet, and Microsoft are strong contenders due to their AI innovations and market dominance.

2. Are AI stocks a good long-term investment?

Yes, AI stocks are considered good long-term investments due to their growing adoption across industries and high market demand.

3. How do I start investing in AI stocks?

You can invest in AI stocks through stock brokerage platforms like TD Ameritrade, Fidelity, or Robinhood. Research companies, analyze financials, and consider AI ETFs for diversification.

4. What AI companies have the highest growth potential?

Companies like NVIDIA, Tesla, Palantir, and Amazon have significant growth potential due to their AI-driven innovations and strong market presence.

Conclusion

AI is reshaping the global economy, and investing in AI stocks presents an incredible opportunity for growth. By carefully evaluating companies, diversifying your portfolio, and staying informed on AI trends, you can make smart investment decisions.

Are you ready to invest in the future of AI? Start researching and take the next step in building a profitable AI investment portfolio today!

Share your thoughts in the comments! What AI stock do you think has the highest potential for 2025?