The Next Digital currency evolution

Digital currency is no longer a concept confined to futuristic discussions—it’s rapidly reshaping how you and millions of others manage money, transact, and interact with financial systems worldwide. Central Bank Digital Currencies, or CBDCs, are at the heart of this transformation, signaling what many experts call the next evolution in digital money.

In this guide, you’ll discover what digital currencies are, how CBDCs function, their benefits and challenges, and what the future holds. By understanding this evolving landscape, you can make smarter financial decisions and be ready for the sweeping changes ahead.

- The Next Digital currency evolution

- Understanding Digital Currency and Its Evolution

- How CBDCs Work : The Backbone of the Next Digital Money Revolution

- Benefits and Challenges of CBDCs for Consumers and Governments

- CBDCs and the Future of Digital Payments

- Looking Ahead : What the Future Holds for Digital Currency

- Embrace the Next Evolution in Digital Currency

Understanding Digital Currency and Its Evolution

What Is Digital Currency ?

Defining the Basics

At its simplest, digital currency is money stored and transacted electronically. Unlike the cash in your wallet, digital currencies exist only in digital form, accessible through your computer, smartphone, or digital wallet apps.

You might already use forms of digital money every day—credit card balances, online bank accounts, or payment apps like Apple Pay and Google Pay. However, when we talk about digital currency in the emerging sense, we refer to a more advanced and secure form that changes how money works at a fundamental level.

The Rise of Cryptocurrencies vs Traditional Money

Cryptocurrencies like Bitcoin and Ethereum burst onto the scene over the last decade, introducing decentralized, peer-to-peer digital money systems operating independently of banks or governments. These currencies rely on blockchain technology—a distributed ledger that records every transaction transparently and securely.

But cryptocurrencies have limitations: volatility, scalability issues, and regulatory uncertainty. That’s where Central Bank Digital Currencies (CBDCs) enter the picture.

Introduction to Central Bank Digital Currencies (CBDCs)

CBDCs are digital versions of your country’s official currency, issued and regulated by the central bank. Unlike cryptocurrencies, CBDCs are centralized and backed by government authority, combining the benefits of digital innovation with trusted governance.

This means your digital dollars, euros, or yuan issued as CBDCs have the same value and legal status as physical notes but are designed for faster, safer, and more inclusive digital transactions.

How Digital Currency Is Shaping the Future of Payments

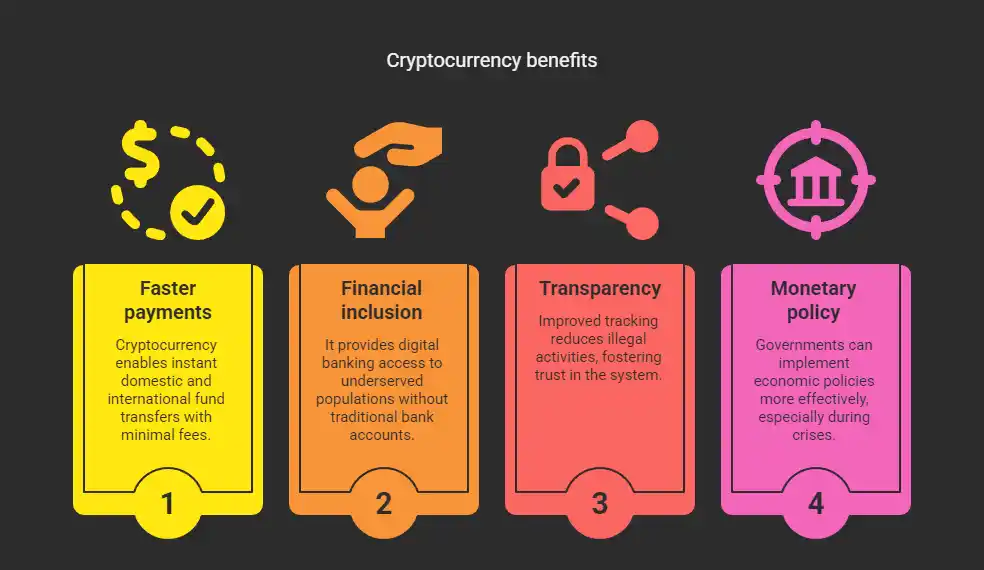

Digital currencies are redefining payments by offering:

- Instant transactions anywhere in the world

- Lower costs compared to traditional bank transfers

- Greater financial inclusion for unbanked populations

- Enhanced transparency to reduce fraud and money laundering

Understanding this evolution helps you grasp why CBDCs are generating so much attention from governments and financial institutions alike.

How CBDCs Work : The Backbone of the Next Digital Money Revolution

The Technology Behind CBDCs: Blockchain and Beyond

CBDCs often leverage blockchain or similar distributed ledger technologies to secure transactions, prevent fraud, and maintain transparency.

But not all CBDCs are blockchain-based; some use centralized ledgers that offer scalability and control advantages. The key is balancing security, speed, privacy, and ease of use so you can transact conveniently without compromising your data.

Key Features of CBDCs Compared to Cryptocurrencies

Here’s what sets CBDCs apart from cryptocurrencies:

- Centralized Control: Issued and regulated by the central bank, ensuring stability.

- Legal Tender: Recognized as official currency for all transactions and debts.

- Privacy Protections: Designed to respect user privacy while enabling anti-fraud measures.

- Interoperability: Compatible with existing financial systems and digital wallets you use daily.

This blend offers you the best of both worlds—digital convenience with the reliability of government backing.

Security and Privacy Considerations in CBDC Implementation

With digital currencies, security is paramount. Central banks work to prevent hacking, fraud, and misuse while protecting your privacy.

You can expect CBDCs to incorporate strong encryption and identity verification systems. At the same time, ongoing debates focus on balancing transparency for regulators with privacy rights for individuals like you.

Examples of CBDCs Around the World: Digital Yuan, Digital Euro, and More

Several countries are pioneering CBDCs:

- Digital Yuan (China): Among the most advanced, widely tested for retail and cross-border payments.

- Digital Euro (European Central Bank): Under development, focusing on privacy and financial stability.

- Digital Dollar (Federal Reserve, USA): Exploration phase, aiming to complement cash and improve payment systems.

These initiatives showcase how CBDCs are tailored to meet each country’s financial ecosystem and regulatory environment, signaling the global momentum behind digital currency evolution.

Benefits and Challenges of CBDCs for Consumers and Governments

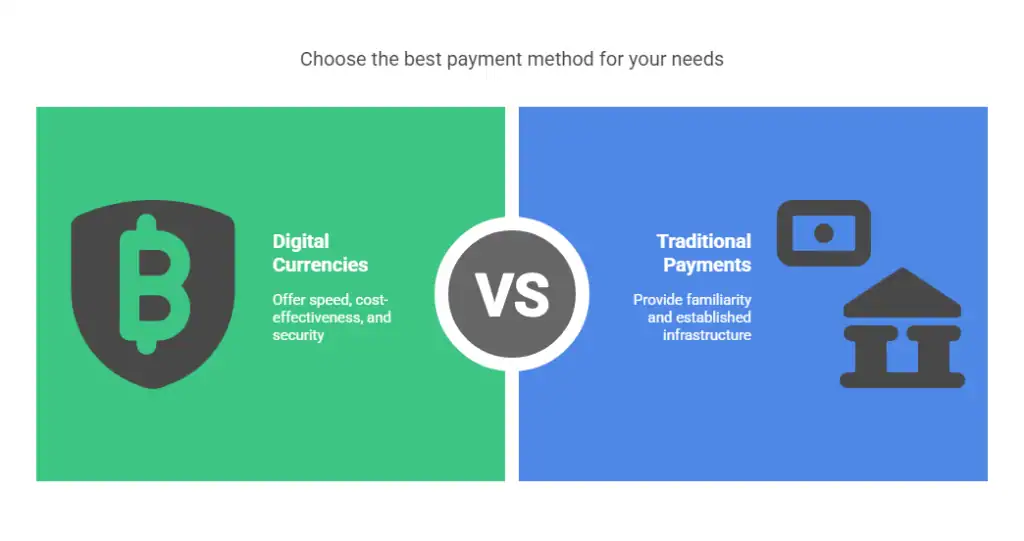

Advantages of CBDCs: Efficiency, Inclusion, and Transparency

CBDCs offer numerous benefits to you and the economy:

- Faster, cheaper payments: Instantly transfer funds domestically or internationally with minimal fees.

- Financial inclusion: Provide digital access to banking services for underserved populations without traditional bank accounts.

- Transparency and fraud reduction: Improved tracking can reduce illegal activities while maintaining trust.

- Monetary policy tools: Governments can more effectively implement economic policies, especially during crises

These benefits make CBDCs a powerful tool to modernize finance and empower individuals.

Potential Risks : Privacy Concerns and Financial Stability

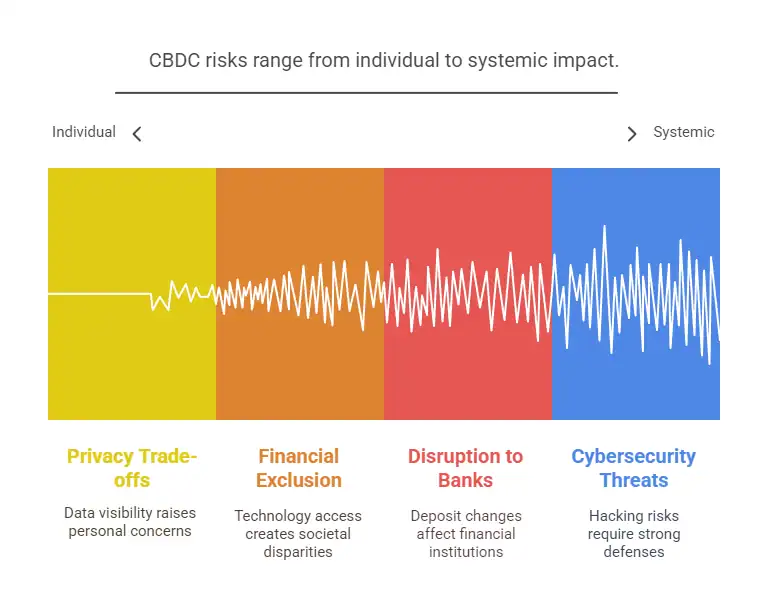

However, the transition isn’t without risks:

- Privacy trade-offs: How much data about your transactions will be visible to authorities? Striking the right balance is critical.

- Disruption to banks: CBDCs may change how banks attract deposits, potentially impacting lending and services you rely on.

- Cybersecurity threats: As digital money grows, so do hacking risks, requiring robust defense mechanisms.

- Financial exclusion risks: If access relies heavily on technology, some populations might be left behind.

Being aware of these challenges helps you navigate the new landscape thoughtfully.

Impact on Traditional Banking and Financial Institutions

CBDCs could reshape traditional banking by:

- Altering how you interact with banks for deposits and loans.

- Encouraging banks to innovate with new digital services.

- Forcing regulatory adaptations to ensure financial stability.

As a user, you might see improved services but should also understand the evolving roles banks will play.

Government Roles and Regulatory Frameworks in CBDC Adoption

Governments globally are crafting regulations to oversee CBDCs, addressing issues like anti-money laundering, consumer protection, and interoperability.

This regulatory framework aims to protect you while fostering innovation—ensuring CBDCs integrate smoothly into everyday financial systems.

CBDCs and the Future of Digital Payments

How CBDCs Facilitate Faster and Cheaper Cross-Border Payments

Cross-border payments today are often slow and expensive due to intermediaries. CBDCs promise to:

- Simplify transactions between countries by allowing direct transfers.

- Reduce costs and settlement times dramatically.

- Increase transparency, reducing fraud and errors.

This could revolutionize how you send money abroad, making it as easy as a local payment.

Integration with Digital Wallets and Mobile Payment Platforms

CBDCs are designed to work seamlessly with the digital wallets and payment apps you already use, like Apple Pay or Google Pay.

This interoperability ensures you don’t have to change habits drastically but enjoy enhanced convenience and security in your transactions.

Role of CBDCs in Promoting Financial Inclusion

By removing barriers like bank account requirements, CBDCs can give millions access to digital financial services.

If you or someone you know lacks access to traditional banking, CBDCs could open new doors—offering safer, faster, and more affordable financial participation.

The Shift Toward a Cashless Society

As digital currencies gain traction, societies move closer to cashless economies.

While this offers benefits like reduced physical handling costs and crime, it also means you’ll need to adapt to new payment methods and ensure digital literacy to navigate this shift confidently.

Looking Ahead : What the Future Holds for Digital Currency

Global Trends and Predictions for CBDC Adoption by 2025 and Beyond

Experts predict:

- More countries will launch pilot CBDCs within the next few years.

- International collaboration to ensure CBDCs can operate across borders efficiently.

- Expansion in digital identity systems supporting CBDC use.

Being informed keeps you ahead as these trends unfold.

Collaboration Between Central Banks and Technology Providers

Successful CBDCs require partnerships between financial authorities and tech companies.

These collaborations ensure secure, scalable, and user-friendly platforms—giving you confidence in the infrastructure behind your digital money.

The Role of International Organizations: IMF, FSB, and Others

Organizations like the International Monetary Fund (IMF) and Financial Stability Board (FSB) are shaping global standards and best practices for CBDCs.

Their work promotes stability and cooperation, which benefits you by fostering a consistent and safe digital currency environment worldwide.

Preparing for the Impact of Digital Currency on Everyday Life

To stay prepared:

- Familiarize yourself with digital wallets and payment platforms.

- Stay updated on CBDC developments in your country.

- Consider how digital money might affect budgeting, saving, and spending habits.

Being proactive ensures you maximize the benefits and minimize potential challenges of this evolution.

Embrace the Next Evolution in Digital Currency

Digital currency is no longer a distant possibility—it’s rapidly becoming a fundamental part of your financial reality. CBDCs, backed by governments and built on cutting-edge technology, promise to transform payments, banking, and financial inclusion.

By understanding the technology, benefits, and challenges, you position yourself to navigate this shift with confidence. The next evolution in digital currency offers exciting opportunities—and with the right knowledge, you can make the most of them.

Are you ready to embrace the future of money? Start exploring digital wallets, follow news on CBDC developments in your region, and consider how digital currencies might fit into your financial plans.

Stay informed, stay secure, and lead your own digital currency revolution.