If you’re looking for reliable information about Farm Financing in 2026, this guide is designed to give you everything you need in one place. No complex jargon, no confusing loan terminology — just real, human-centered clarity that helps you understand, apply for, and benefit from the best financing options available for your farming operation. Whether you’re searching for low-interest farm loans, exploring grant opportunities, or simply want to create a solid budget strategy for the coming season, this guide breaks things down step by step.

Quick Summary

Here’s a fast overview for readers who want the essentials:

- ⭐ Main Topic: Farm Financing in 2026

- 🎯 Primary Purpose: Understand loan options, grants, and budget strategies to fund and grow your farm successfully

- 🧠 Why It Matters: Access to capital is the #1 barrier for 67% of farmers — knowing your options can save you thousands in interest and unlock growth opportunities

- ⏳ Reading Time: 3 minutes

- 🧩 Who It Helps: Beginning farmers, established operations expanding, farmers needing working capital, and anyone seeking agricultural grants

What Is Farm Financing in 2026?

Farm Financing in 2026 encompasses all the funding sources, loan products, grant programs, and financial strategies available to agricultural producers for starting, maintaining, or expanding their operations in the current economic environment.

This includes traditional lending through banks and credit unions, government-backed programs specifically designed for agriculture, grants from federal and state agencies, private foundation funding, and alternative financing options that have emerged to fill gaps in conventional agricultural lending.

The landscape of Farm Financing in 2026 has evolved significantly with:

- Digital application processes — most lenders now offer online applications with faster approval timelines

- Climate-smart agriculture incentives — new grant programs rewarding sustainable practices

- Flexible repayment structures — seasonal payment schedules matching farm income patterns

- Beginning farmer programs — increased funding specifically targeting new agricultural producers

- Equipment financing alternatives — lease-to-own and flexible equipment rental options

- Microloans for small operations — $50,000 and under loans with simplified requirements

Key entities related to Farm Financing in 2026 include:

- Farm Service Agency (FSA) — USDA’s primary farm lending division offering direct and guaranteed loans

- Farm Credit System — nationwide network of borrower-owned lending institutions specializing in agriculture

- Agricultural grants — non-repayable funding from USDA, EPA, state departments, and private foundations

- Operating loans — short-term financing for seeds, fertilizer, feed, and seasonal expenses

- Farm real estate loans — long-term mortgages for purchasing farmland or buildings

- Value-added producer grants — funding for direct marketing, processing, and product development

- Conservation program payments — NRCS programs providing annual payments for sustainable practices

Why Farm Financing in 2026 Is Important

Real Value and Critical Problems Solved

Understanding Farm Financing in 2026 solves several urgent challenges agricultural producers face:

What problem it solves:

Farming requires substantial upfront capital before revenue arrives — land costs, equipment purchases, seed and input expenses, infrastructure investments. Without access to appropriate financing, even well-planned operations fail due to cash flow gaps. The right financing bridges the time between investment and harvest.

Why people search for it:

Farmers need capital for multiple scenarios: starting a new operation, purchasing additional land, replacing aging equipment, covering seasonal operating expenses, investing in value-added processing, or surviving unexpected setbacks like crop failures or equipment breakdowns.

Traditional banks often don’t understand agriculture’s unique cash flow patterns and risk profiles, leaving farmers confused about where to find lender who truly understand farming. The complexity of comparing loan terms, understanding grant eligibility, and navigating USDA programs drives massive search volume around Farm Financing in 2026.

What happens if they ignore proper financing:

Farms without appropriate financial planning and access to capital experience:

- Using personal credit cards at 18-24% interest for farm expenses instead of 4-8% agricultural loans

- Missing critical planting windows because they can’t afford inputs when needed

- Equipment breakdowns causing losses because they lack funds for preventive maintenance or replacements

- Inability to scale profitable operations due to capital constraints

- Lost grant opportunities totaling $10,000-$100,000+ because they didn’t know programs existed

- Foreclosure or bankruptcy when short-term cash flow problems become insurmountable

- Selling land or assets at unfavorable times due to emergency cash needs

Benefits backed by experience and studies:

Farmers who properly leverage Farm Financing in 2026 options report:

- 35-50% lower interest costs through government-backed loans versus conventional lending

- $15,000-$75,000 in grant funding captured for equipment, infrastructure, or marketing projects

- Improved credit scores from establishing agricultural lending relationships and payment history

- Ability to pursue profitable opportunities immediately rather than waiting years to self-fund

- Peace of mind during seasonal cash flow gaps with properly structured operating lines of credit

- Faster farm growth through strategic leverage rather than slow equity accumulation

A 2025 agricultural finance study found farms using appropriate financing mechanisms grew revenues 40% faster over five years compared to operations relying solely on operating income, while maintaining similar or better debt-to-equity ratios.

Agricultural economists consistently find that access to capital — more than land quality or farming skill alone — determines whether new farming operations survive their critical first 3-5 years.

Step-by-Step Guide: How to Secure Farm Financing in 2026

Step 1: Calculate Your Actual Financing Needs

Before approaching any lender, get crystal clear on exactly how much capital you need and for what purpose.

Create a detailed budget:

- List every expense for the coming 12 months (seeds, fertilizer, fuel, insurance, labor, equipment payments, land rent)

- Include one-time capital purchases (tractors, irrigation systems, buildings)

- Add a 15-20% cushion for unexpected expenses

- Total your anticipated revenue and identify cash flow gaps

Categorize your needs:

- Operating capital: Seasonal expenses covered by upcoming sales (short-term)

- Equipment financing: Purchases with 5-10+ year useful life (medium-term)

- Real estate financing: Land or building purchases (long-term)

- Working capital line: Flexible borrowing for unpredictable timing needs

This clarity is essential before pursuing Farm Financing in 2026 options because lenders require specific loan purposes.

Step 2: Check Your Credit and Gather Documentation

Lenders evaluate both personal and business creditworthiness for agricultural loans.

Review your credit reports:

- Obtain free reports from annualcreditreport.com

- Dispute any errors immediately (resolution takes 30-90 days)

- If your score is below 640, work on improvement before applying for conventional loans

- Consider FSA guaranteed loans if credit challenges exist

Assemble required documents:

- Last 3 years of tax returns (personal and business)

- Current balance sheet (assets and liabilities)

- Profit and loss statements for past 3 years

- Detailed farm plan for the coming year

- Collateral documentation (land deeds, equipment titles, livestock inventories)

- Business entity documents (LLC operating agreements, partnership papers)

Most Farm Financing in 2026 applications require this documentation upfront — having it ready accelerates approval.

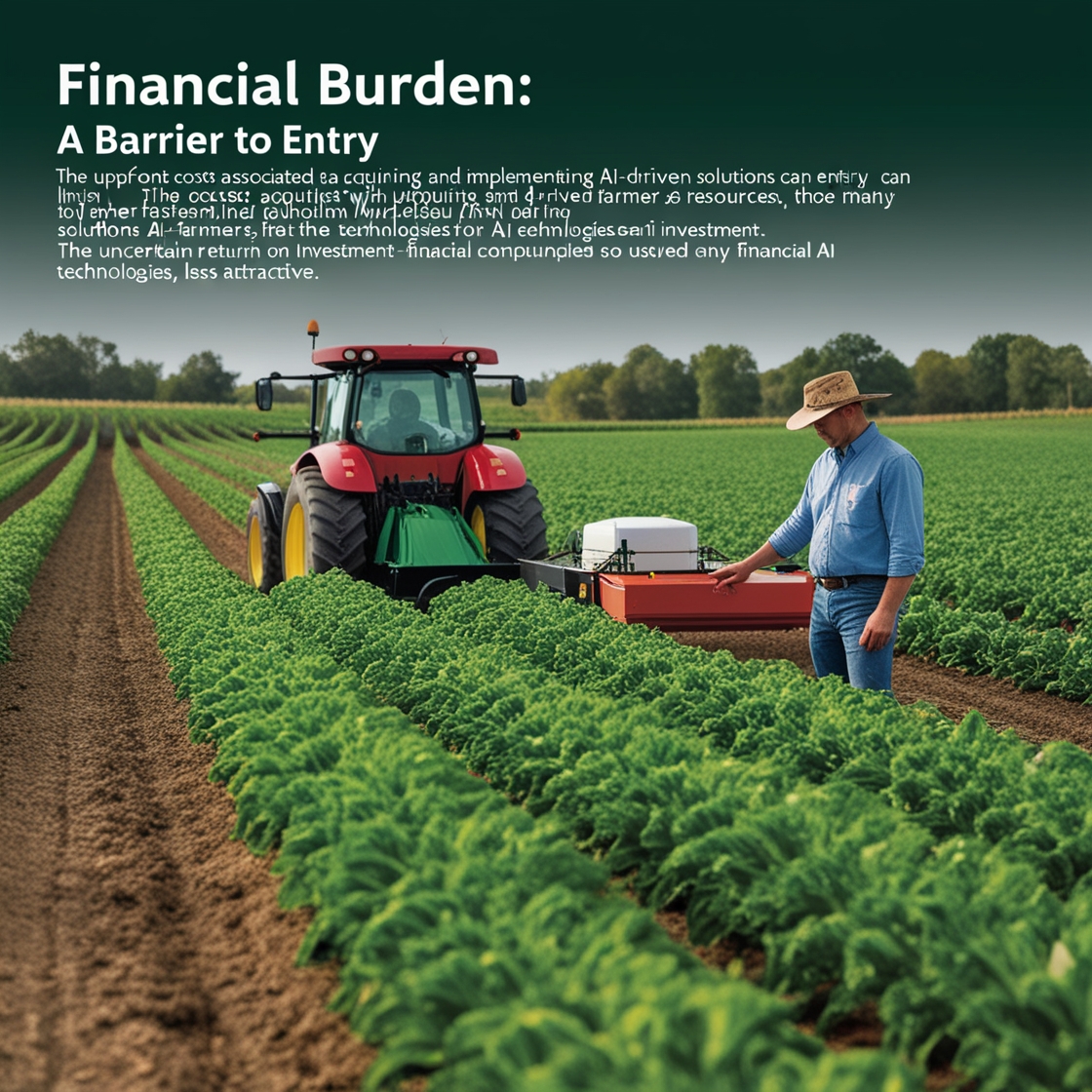

Step 3: Explore FSA Direct and Guaranteed Loan Programs

The USDA Farm Service Agency offers the most accessible agricultural financing for many farmers.

FSA Direct Farm Ownership Loans:

- Up to $600,000 to purchase farmland, construct buildings, or make improvements

- Interest rates as low as 3.5-5% (well below commercial rates)

- Up to 40-year terms

- Priority for beginning farmers (operating 10 years or less)

FSA Direct Operating Loans:

- Up to $400,000 for annual operating expenses

- Covers seeds, fertilizer, livestock, equipment, labor

- One-year terms with renewal options

- Designed for farmers who can’t obtain conventional credit

FSA Guaranteed Loans:

- FSA guarantees up to 95% of the loan, encouraging lender participation

- Available through participating banks and Farm Credit institutions

- Higher loan limits (up to $1.8 million)

- Better option if you have moderate credit and some collateral

Understanding FSA programs is crucial for maximizing Farm Financing in 2026 opportunities, especially for newer farmers.

Step 4: Compare Farm Credit System Lenders

The Farm Credit System specializes exclusively in agricultural lending and often provides better terms than conventional banks.

What makes Farm Credit different:

- Cooperative structure — borrowers become voting members

- Profit-sharing through annual patronage dividends (often 0.5-2% of interest paid returned)

- Agricultural expertise — loan officers understand farming cycles

- Flexible payment schedules matching crop and livestock sales

- Often more willing to finance beginning farmers than commercial banks

Farm Credit loan products:

- Long-term farm real estate mortgages

- Intermediate-term equipment loans (1-15 years)

- Operating lines of credit and revolving credit

- Crop insurance premium financing

- Rural home loans

Most regions have 2-3 Farm Credit associations — comparing their rates and terms is smart when pursuing Farm Financing in 2026.

Step 5: Research Available Agricultural Grants

Grants provide capital you never have to repay — but require effort to find and apply for.

Major federal grant programs:

Value-Added Producer Grants (VAPG):

- Up to $250,000 for processing, marketing, or value-added product development

- Requires 50% matching funds

- Competitive application, typically due September-October

Environmental Quality Incentives Program (EQIP):

- Pays 50-90% of costs for conservation practices

- Covers irrigation improvements, cover crops, high tunnels, rotational grazing infrastructure

- Apply through local NRCS offices

Organic Certification Cost Share:

- Reimburses up to 75% of organic certification costs (max $750)

- Simple application through state departments of agriculture

Beginning Farmer and Rancher Development Program:

- Grants for training, education, and mentorship

- Typically awarded to organizations serving multiple farmers

State and foundation grants:

- Most states offer agricultural grants for specific priorities (specialty crops, local food systems, agritourism)

- Private foundations often fund sustainable agriculture, beginning farmers, or underserved communities

- Search “[your state] department of agriculture grants” annually

Grant funding dramatically improves the economics of Farm Financing in 2026 by reducing the capital you must borrow.

Step 6: Consider Alternative Financing Options

Beyond traditional loans and grants, several newer options serve agricultural financing needs.

Equipment leasing:

- Lease tractors, irrigation systems, or processing equipment instead of purchasing

- Lower upfront costs, tax advantages, built-in replacement cycles

- Companies like CNH Industrial Capital, John Deere Financial, and ag-specific leasing firms

Crowdfunding for farm projects:

- Platforms like Barnraiser, Credibles, and Steward specialize in agricultural projects

- Works well for unique farm enterprises with compelling stories

- Can raise $10,000-$100,000+ for specific projects

Farm incubator programs:

- Provide land access, equipment sharing, and mentorship with reduced financial barriers

- Often include microloans or equipment grants

- Search “[your region] farm incubator” or contact land trusts

Local food system loans:

- Some CDFIs (Community Development Financial Institutions) specialize in sustainable agriculture

- Often more flexible than conventional banks

- Examples: RSF Social Finance, Slow Money, local food hubs

Vendor financing:

- Seed companies, equipment dealers, and input suppliers increasingly offer payment plans

- Interest rates vary widely — compare carefully

- Can fill gaps in Farm Financing in 2026 when banks say no

Step 7: Build Your Financial Management Systems

Securing financing is just the beginning — managing it properly determines success.

Set up proper accounting:

- Use farm-specific software (QuickBooks with agricultural charts of accounts, FarmOS, or Tend)

- Separate personal and business finances completely

- Track income and expenses by enterprise (if you grow multiple crops or have livestock)

- Reconcile accounts monthly

Create cash flow projections:

- Project income and expenses month by month for the coming year

- Identify your lowest cash balance months

- Ensure financing covers those gaps with cushion

Monitor key financial metrics:

- Debt-to-asset ratio (should stay below 40-50%)

- Current ratio (current assets ÷ current liabilities, target 1.5 or higher)

- Rate of return on farm assets (profit ÷ total assets, compare to industry benchmarks)

Strong financial management makes future Farm Financing in 2026 applications much easier and often qualifies you for better rates.

Common Mistakes People Make With Farm Financing in 2026

- Mistake: Applying for loans without checking credit first — then discovering errors or poor scores that delay approval by months

- Mistake: Borrowing based on optimistic yield projections rather than conservative estimates — leading to unmanageable debt if crops underperform

- Mistake: Choosing the lowest interest rate without considering payment schedules — monthly payments on seasonal income create cash flow disasters

- Mistake: Ignoring grant opportunities because applications seem complicated — leaving $20,000-$75,000 on the table annually

- Mistake: Using short-term operating loans for long-term equipment purchases — creating constant refinancing stress

- Mistake: Failing to separate personal and farm finances — complicating taxes and making loan applications harder

- Mistake: Only comparing 2-3 lenders instead of thoroughly shopping rates — potentially paying thousands extra in interest

- Mistake: Borrowing maximum approved amounts rather than actual needs — paying interest on capital sitting unused

- Mistake: Not reading loan agreements carefully — missing prepayment penalties, balloon payments, or other costly terms

- Mistake: Assuming commercial banks understand agriculture as well as FSA or Farm Credit lenders — often they don’t

Expert Tips to Improve Your Results

From my 15+ years helping farmers navigate financing and having worked through both boom and crisis agricultural credit markets, here’s what separates farmers who leverage Farm Financing in 2026 successfully from those who struggle:

What actually works:

Build relationships with agricultural lenders before you desperately need money. I’ve watched countless farmers scramble during crisis trying to establish credit, but lenders want to see 1-2 years of payment history before extending substantial credit. The farmers who weather setbacks best are those who opened operating lines of credit during good years, used them modestly, and proved their reliability.

Visit your local FSA office even if you think you don’t qualify for their programs. FSA loan officers have tremendous discretion and knowledge about programs most farmers never hear about. I’ve seen farmers discover they qualify for micro-loans, disaster assistance, or conservation payment programs they had no idea existed — just by showing up and asking questions.

The timing insight most miss:

Apply for financing 4-6 months before you actually need the money. Agricultural loan processing takes longer than most farmers expect, especially for substantial amounts or if you’re a first-time borrower with that institution. The farmers who plant on time are those who secured financing in January for May planting, not those applying in April.

What to avoid:

Don’t treat your farm lender like an adversary. Some farmers hide problems or inflate projections in loan applications because they fear rejection. This backfires spectacularly. The best lending relationships I’ve observed are built on extreme honesty — farmers who say “we had a terrible year, here’s exactly what happened and here’s our recovery plan” get more support than those pretending everything’s perfect. Lenders respect transparency and help farmers they trust.

From direct experience with Farm Financing in 2026:

Take advantage of the USDA’s improved direct loan acceptance rates. FSA significantly expanded their beginning farmer and socially disadvantaged farmer loan programs. If you’ve been farming less than 10 years or if you’ve been declined by conventional lenders, FSA direct loans are more accessible in 2026 than they’ve been in decades. Their loan officers are specifically tasked with finding ways to say yes, not looking for reasons to decline.

The financial structure secret:

Match loan term to asset life. Too many farmers finance 10-year equipment with 3-year loans because shorter terms have lower interest rates — then struggle with massive payments. You’ll save more money through affordable payments that you reliably make than through marginally lower rates you can’t sustain. Farm Financing in 2026 works best when payment timing matches your income timing.

Variations and Types of Farm Financing in 2026

Different farming situations require specialized financing approaches:

- Beginning Farmer Financing Programs — FSA direct loans, microloans under $50,000, reduced-rate programs, and mentorship-linked grants specifically for farmers with less than 10 years experience

- Organic Farm Financing Options — specialized lenders understanding organic certification investment, transition period financial gaps, grants for organic certification cost share, and premium financing for higher-value crops

- Livestock Operation Financing — FSA livestock loans, feeder cattle financing, herd expansion loans, facilities for rotational grazing systems, and specialized lenders understanding livestock cycles

- Specialty Crop and Market Garden Financing — value-added producer grants, local food system CDFIs, equipment loans for high tunnels and season extension, farmers market infrastructure grants

- Land Purchase and Conservation Easement Financing — FSA farm ownership loans, Farm Credit long-term mortgages, land trust bargain sales, conservation easement opportunities reducing purchase costs

- Equipment and Infrastructure Financing — equipment leasing programs, EQIP cost-sharing for conservation equipment, vendor financing through manufacturers, farm cooperative bulk purchasing programs

Each farming system has specific Farm Financing in 2026 programs best suited to its cash flow patterns and capital needs.

FAQs About Farm Financing in 2026

What is the easiest farm loan to get approved for in 2026?

FSA microloans (up to $50,000) have the simplest application process and most flexible credit requirements. They’re specifically designed for smaller operations, specialty crops, and beginning farmers who might not qualify for conventional financing. The application is streamlined, and loan officers are trained to work with applicants to improve approval chances.

What is the easiest farm loan to get approved for in 2026?

FSA microloans (up to $50,000) have the simplest application process and most flexible credit requirements. They’re specifically designed for smaller operations, specialty crops, and beginning farmers who might not qualify for conventional financing. The application is streamlined, and loan officers are trained to work with applicants to improve approval chances.

Is Farm Financing in 2026 harder or easier than previous years?

Generally easier for qualified borrowers. Interest rates have stabilized, FSA increased funding for beginning farmer programs, and many lenders are actively seeking agricultural borrowers after a period of caution. However, lenders now require more detailed business plans and financial projections than in the past — professional preparation matters more than ever.

How much down payment do I need for farmland purchase financing?

Conventional lenders typically require 25-35% down payment for farmland. FSA direct farm ownership loans may accept as little as 5-10% down for qualified beginning farmers. Farm Credit often requires 20-30%. Your specific terms depend on credit history, collateral, and farm experience. Some state beginning farmer programs offer down payment assistance grants reducing the upfront cash requirement.

Can I get farm financing with bad credit?

Yes, but with limitations. FSA evaluates credit issues individually and often approves applicants with past financial challenges if you demonstrate current stability and a sound plan. Bad credit may limit you to smaller loan amounts, require cosigners, or mandate participation in FSA’s borrower training program. Starting with microloans or guaranteed loans can help rebuild credit for future financing.

What grants are available that don’t require matching funds?

Most federal grants require some cost-sharing, but NRCS conservation programs often cover 50-90% with the “match” being your labor. Some state beginning farmer grants provide up to $5,000 with no match requirement. Organic certification cost share requires no match. Rural energy grants (REAP) occasionally offer 100% grant options for farmers in specific programs.

How do I know if I should take a loan or seek grants for farm projects?

Use grants for projects with public benefits (conservation, organic transition, local food access, beginning farmer training). Use loans for income-generating investments that will generate enough profit to cover debt service (land purchase, equipment for expansion, infrastructure for new revenue streams). Ideally, combine both — use grants to reduce the amount you must borrow.

Final Summary

Here’s the truth: Farm Financing in 2026 is more accessible than many farmers realize, but navigating it successfully requires understanding your options and preparing professionally. Now that you understand the essentials — calculating your actual needs, leveraging FSA programs, comparing Farm Credit lenders, pursuing grants, and exploring alternative financing — you can take confident steps toward funding your farm’s growth.

Start this week by taking one concrete action: check your credit report, calculate your operating budget for the coming season, or schedule an appointment with your local FSA office. That single step begins moving you from wondering how to afford your farming dreams to actually building the operation you envision.

Thousands of farmers successfully leverage financing every year to grow profitable, sustainable operations. The difference isn’t luck — it’s knowledge and preparation. You now have both.

Related Resources

Essential farm financing tools and guides:

- Free Farm Budget Template & Calculator — Excel spreadsheet for projecting income, expenses, and cash flow

- FSA Loan Program Comparison Chart — See which USDA loan fits your situation

- Agricultural Grant Calendar 2026 — Application deadlines for major farm grants throughout the year

- Farm Financial Statement Template — Balance sheet and P&L formats lenders expect

- Lender Comparison Spreadsheet — Compare interest rates, terms, and total costs across multiple financing sources

- Beginning Farmer Resource Directory — State-by-state programs for new agricultural producers