Sales Tax Calculator: How to Easily Calculate Tax in 3 Steps

Introduction

Calculating sales tax can feel like solving a complicated math problem, but what if I told you it could be as easy as 1-2-3? Whether you’re budgeting for a big purchase, preparing a receipt, or just curious about how much you’re really spending, the Sales Tax Calculator is here to save the day. This handy tool takes the guesswork out of tax calculations, making it quick, accurate, and stress-free.

Did you know that sales tax rates can vary widely depending on your location? For example, in the U.S., rates range from 0% in some states to over 10% in others. That’s why having a reliable calculator is essential. Think of it as your personal financial assistant, always ready to help you figure out how much is the tax on a dollar or how much with tax your total will be.

Ready to simplify your life? Let’s dive into how this tool works and why it’s a must-have for everyone.

Sales Tax Calculator

Results

Tax Amount ($): 0.00

Base Amount ($): 0.00

What is a Sales Tax Calculator?

Ever wondered, “How do I figure out sales tax without pulling my hair out?” That’s where the Sales Tax Calculator comes in! This nifty tool is designed to make tax calculations a breeze. Whether you’re a shopper, a business owner, or just someone who hates math, this calculator is your new best friend.

The name says it all—Sales Tax Calculator—but don’t let its simplicity fool you. It’s packed with features to help you determine the before-tax price, the after-tax price, or even the tax rate itself. And the best part? It’s free and easy to use. So, why not give it a try and see how much time and effort you can save?

Why You’ll Love This Sales Tax Calculator

- Quick and Accurate Results

No more manual calculations or second-guessing. The Sales Tax Calculator gives you precise results in seconds. - Cost-Saving Benefits

Avoid overpaying or undercharging by knowing exactly how much with tax your total will be. - User-Friendly Interface

Whether you’re a tech pro or a beginner, this tool is designed for everyone. Plus, it’s mobile-friendly, so you can use it on the go.

Compared to other financial tools, the Sales Tax Calculator stands out for its simplicity and versatility. It’s like having a financial expert in your pocket!

How to Use the Sales Tax Calculator

Quick Overview

Using the Sales Tax Calculator is as easy as pie. In just 3 simple steps, you can calculate:

- The after-tax price from the before-tax price and tax rate.

- The before-tax price from the after-tax price and tax rate.

- The tax rate from the before-tax and after-tax prices.

It’s fast, accurate, and perfect for anyone who wants to save time and avoid headaches.

Key Ingredients for the Sales Tax Calculator

To use the Sales Tax Calculator, you’ll need:

- Before-Tax Price: The original price of the item.

- Sales Tax Rate: The percentage of tax applied (e.g., 7%).

- After-Tax Price: The total price including tax.

Just like baking a cake, you only need a few key ingredients to get the perfect result!

Step-by-Step Instructions

- Step 1: Enter Two Values

- Input the before-tax price and sales tax rate to calculate the after-tax price.

- Or, input the before-tax price and after-tax price to find the tax rate.

- Alternatively, input the sales tax rate and after-tax price to determine the before-tax price.

- Step 2: Click “Calculate”

- Let the tool do the math for you. It’s that simple!

- Step 3: View Your Results

- Instantly see the missing value, whether it’s the tax amount, before-tax price, or after-tax price.

What to Pair with the Sales Tax Calculator

- Budgeting Tools: Pair the calculator with a budgeting app to track your expenses.

- Receipt Templates: Use it to create accurate receipts for your business.

- Tax Rate Lookup Tools: Combine it with a find sales tax by zip code tool for location-specific rates.

Top Tips for Perfecting Your Tax Calculations

- Double-Check Your Inputs

Ensure you’ve entered the correct values to avoid errors. - Use Location-Specific Rates

If you’re unsure about the tax rate, use a find sales tax by zip code tool for accuracy. - Round Off for Simplicity

Round your results to two decimal places for easy readability.

Storing and Reheating Tips

- Save Your Calculations: Bookmark the calculator for quick access in the future.

- Share with Others: Send the link to friends or colleagues who might find it useful.

- Print Your Results: Keep a hard copy for your records if needed.

Conclusion

The Sales Tax Calculator is more than just a tool—it’s a game-changer for anyone who wants to simplify their financial calculations. Whether you’re figuring out how do you calculate sales tax or determining how much is the tax on a dollar, this calculator has you covered.

So, why wait? Try the Sales Tax Calculator today and see how easy it can be to master your finances. And don’t forget to share your experience in the comments below!

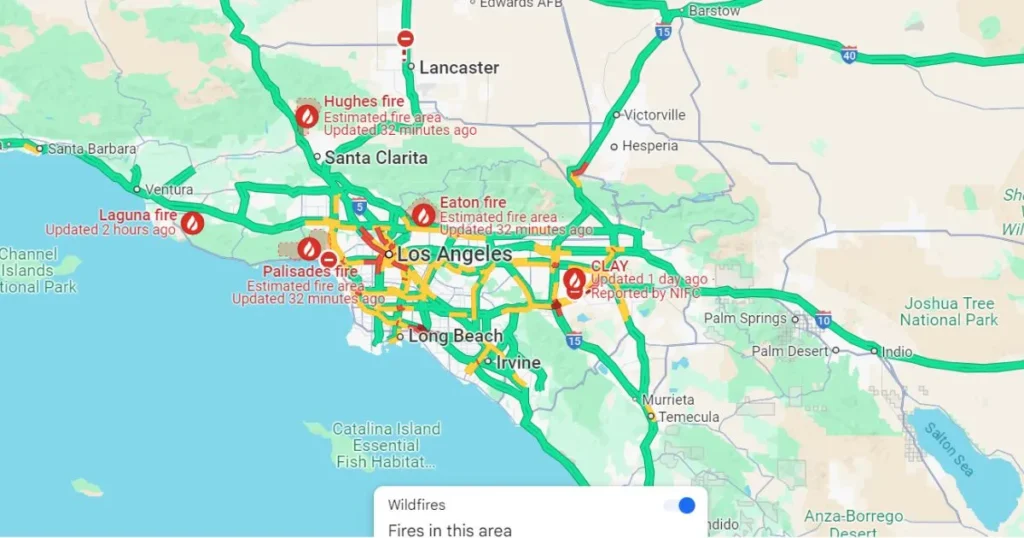

5 Ways to Locate the Hughes Fire5 Ways to Locate the Hughes Fire

The following is an overview of the sales tax rates for different states.

Here’s a complete table of sales tax rates by state in the United States, including general state taxes and maximum local taxes. This table is designed to be clear, easy to read, and helpful for your readers.

Table of Sales Tax Rates by State in the U.S.

| State | General State Tax | Maximum Local Tax | Combined Maximum Rate |

|---|---|---|---|

| Alabama | 4% | 7.50% | 11.50% |

| Alaska | 0% | 7% | 7% |

| Arizona | 5.60% | 5.125% | 10.725% |

| Arkansas | 6.50% | 5.125% | 11.625% |

| California | 7.25% | 3.25% | 10.50% |

| Colorado | 2.90% | 7.10% | 10% |

| Connecticut | 6.35% | 0% | 6.35% |

| Delaware | 0% | 0% | 0% |

| District of Columbia | 6% | 0% | 6% |

| Florida | 6% | 1.50% | 7.50% |

| Georgia | 4% | 4% | 8% |

| Hawaii | 4% | 0.546% | 4.712% |

| Idaho | 6% | 2.50% | 8.50% |

| Illinois | 6.25% | 4% | 10.25% |

| Indiana | 7% | 0% | 7% |

| Iowa | 6% | 1% | 7% |

| Kansas | 6.50% | 5.10% | 11.60% |

| Kentucky | 6% | 0% | 6% |

| Louisiana | 4.45% | 7% | 11.45% |

| Maine | 5.50% | 0% | 5.50% |

| Maryland | 6% | 0% | 6% |

| Massachusetts | 6.25% | 0% | 6.25% |

| Michigan | 6% | 0% | 6% |

| Minnesota | 6.875% | 1% | 7.875% |

| Mississippi | 7% | 0.25% | 7.25% |

| Missouri | 4.225% | 6.625% | 10.85% |

| Montana | 0% | 0% | 0% |

| Nebraska | 5.50% | 2% | 7.50% |

| Nevada | 6.85% | 1.525% | 8.375% |

| New Hampshire | 0% | 0% | 0% |

| New Jersey | 6.625% | 6% | 12.625% |

| New Mexico | 5.125% | 3.563% | 8.688% |

| New York | 4% | 4.875% | 8.875% |

| North Carolina | 4.75% | 2.75% | 7.50% |

| North Dakota | 5% | 3% | 8% |

| Ohio | 5.75% | 2.25% | 8% |

| Oklahoma | 4.50% | 6.50% | 11% |

| Oregon | 0% | 0% | 0% |

| Pennsylvania | 6% | 2% | 8% |

| Rhode Island | 7% | 0% | 7% |

| South Carolina | 6% | 3% | 9% |

| South Dakota | 4% | 2% | 6% |

| Tennessee | 7% | 2.75% | 9.75% |

| Texas | 6.25% | 2% | 8.25% |

| Utah | 6.10% | 2.25% | 8.35% |

| Vermont | 6% | 1% | 7% |

| Virginia | 5.30% | 1.70% | 7% |

| Washington | 6.50% | 4.10% | 10.60% |

| West Virginia | 6% | 1% | 7% |

| Wisconsin | 5% | 1.90% | 6.90% |

| Wyoming | 4% | 2% | 6% |

Key Notes:

- General State Tax: The base sales tax rate imposed by the state.

- Maximum Local Tax: The highest additional tax rate that can be applied by local jurisdictions (cities, counties, etc.).

- Combined Maximum Rate: The total sales tax rate when state and local taxes are combined.

How to Use This Table:

- If you’re calculating sales tax for a specific location, check the Combined Maximum Rate for the highest possible tax.

- Use a find sales tax by zip code tool for precise local rates, as they can vary within a state.

This table is a great resource for anyone looking to understand sales tax rates across the U.S. Let me know if you need further adjustments or additional details! 😊

This article, titled “Sales Tax Calculator: How to Easily Calculate Tax in 3 Steps”, provides a comprehensive guide on using a Sales Tax Calculator to determine the before-tax price, after-tax price, or sales tax rate. It’s designed for shoppers, business owners, and anyone looking to simplify their financial calculations. The article includes step-by-step instructions, practical examples, and tips for accurate tax calculations.